20+ tax return mortgage

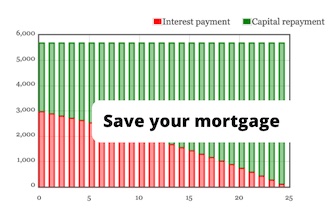

Wage earner W2 and pay stub. Web From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income.

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

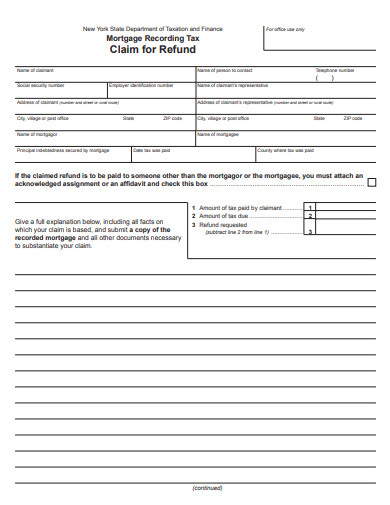

Web For tax years prior to 2018 the maximum amount of debt eligible for the deduction was 1 million.

. Beginning in 2018 the maximum amount of debt is limited to. Compare Offers From Our Partners To Find One For You. Ad Over 90 million taxes filed with TaxAct.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Retirement might be decades away. Our free services are for families who made up to 60000 and individuals who made up to 40000 in 2022.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Mortgages you or your spouse if married filing a joint return took out after December 15 2017 to buy build or substantially improve your home called home acquisition debt. Web For a simplified example a taxpayer spending 12000 on mortgage interest and paying taxes at an individual income tax rate of 24 would be permitted to exclude.

Your Income and Assets. Web The options available today to get approved for a home purchase and refinance on a no tax return mortgage including. For conventional or government.

Web 1 day agoIf you make any amount of money even if you dont have to pay taxes filing your return will help grow your RRSP contribution room. Here are the things most mortgage lenders look for on your tax returns. Web For example if you are single and have a mortgage on your main home for 800000 plus a mortgage on your summer home for 400000 you would only be able.

Web Rocket Mortgage makes it easy to get a mortgage you just tell the company about yourself your home your finances and Rocket Mortgage gives you. Start basic federal filing for free. TaxAct helps you maximize your deductions with easy to use tax filing software.

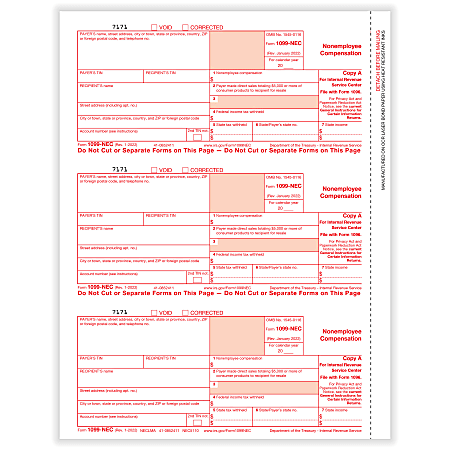

Web Mortgage loan W2 or tax returns W2 employee with good pay. Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. Get Your Max Refund Guaranteed.

Home loan solution for self-employed borrowers using bank statements. All of the rental income you earn will be taxable and youll instead receive. Web Just Harvests 2022 tax season runs from January 23 to April 18.

Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. Home loan solution for self-employed borrowers using bank statements. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web Generally the same tax deductions are available when youre refinancing a mortgage as when youre taking out a new mortgage to buy a home. Web Self employed home buyers can qualify for a mortgage based upon their average monthly bank deposits without having to provide tax returns. Our Tax Pros Have an Average Of 10 Years Experience.

Web If line 2 is 20 or less multiply line 1 by line 2. If line 2 is more than 20 or you refinanced your mortgage and received a reissued certificate see the instructions for the amount to. Mortgage loan W2 or tax returns.

Another example applies to. Web TAX RATE The state income tax rate for 2020 is 307 percent 00307. Web When you apply for a mortgage your lender is likely to ask you to provide financial documentation which may include 1 to 2 years worth of tax returns.

Web What Do Mortgage Lenders Look for on Tax Returns. See if you qualify. Ad Dedicated to helping retirees maintain their financial well-being.

Web Most homeowners can deduct all of their mortgage interest. Ad Dont Leave Money On The Table with HR Block. 2120 2620 - 500 That 2120 monthly budget will get you a much lower loan amount than the full 5830 monthly income.

2020 TAX RETURN FILING DUE DATE To remain consistent with the federal tax due date the due date for. Web Along with eligible work expenses personal itemized deductions can include mortgage interest retirement contributions property taxes charitable donations.

How The Federal Reserve Impacts Mortgage Rates Independence Title

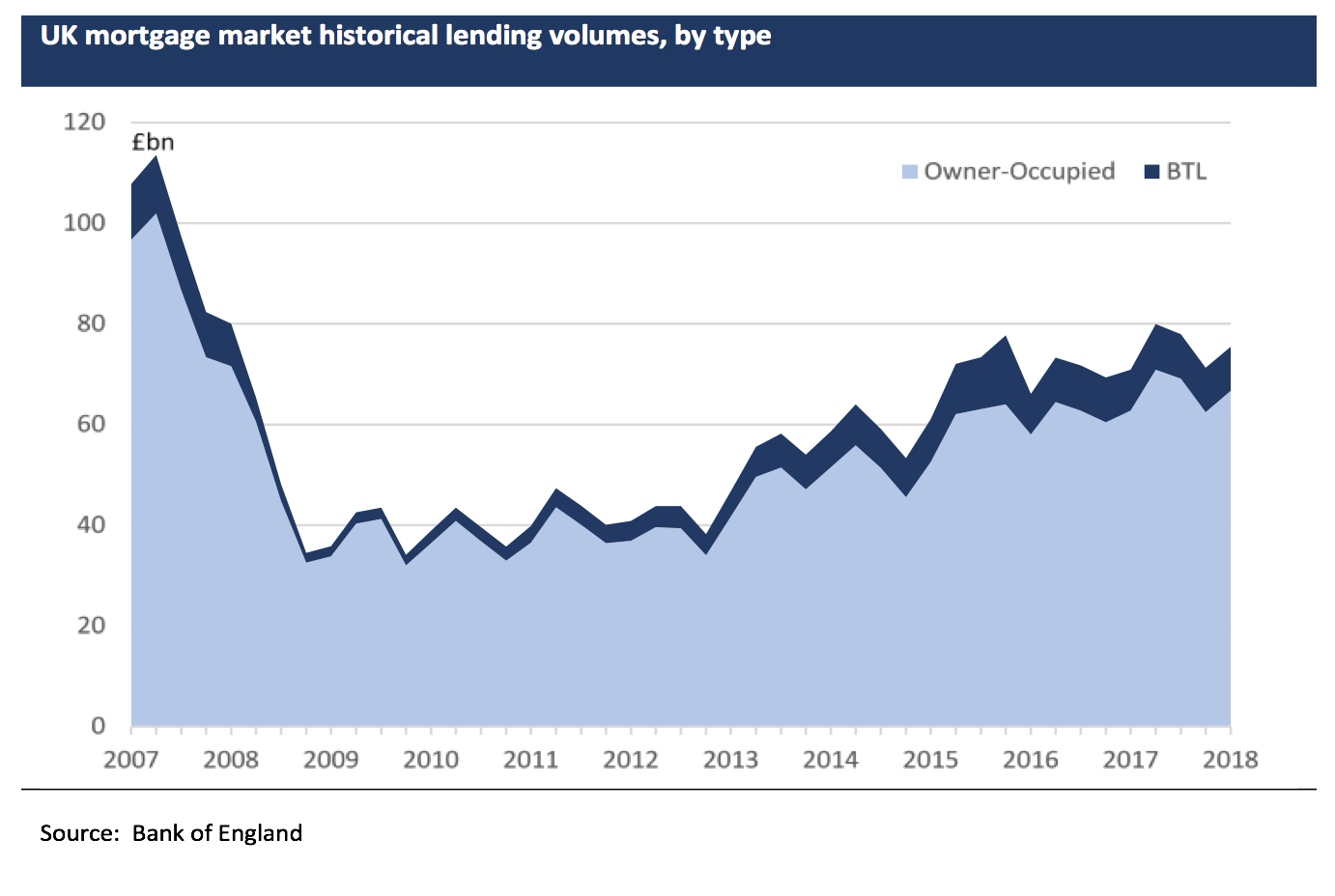

Buy To Let Mortgage Interest Tax Relief Explained Which

All Citizens Tax Prep Checklist 2017

Should I Prepay Home Loan If I Get Extra Money Quora

Integer Advisors

Six Secret Steps To Mortgage Success For The Self Employed Springtide Capital

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

Resume Jpd 4 22 16

Top 10 Rental Property Tax Return Mistakes After 20 Years

Mortgage Crash To Smash House Prices Lower Macrobusiness

2 To 4 Unit Home How To Buy A Multi Unit Property

Office Depot

10 Mortgage Form Templates In Pdf Doc

February 2021 The Dancing Accountant

Why Making Monthly Payments On A Repayment Mortgage Is A Form Of Saving Monevator

Mortgage Without Tax Returns Required Options For 2023 Dream Home Financing

113 Remic Stock Photos Free Royalty Free Stock Photos From Dreamstime